Employment

Overview

Employment laws are constantly changing, and the associated risks and liabilities for employers are continually increasing. Working with both small and large employers, the Employment Law Department of Ervin Cohen & Jessup LLP takes a preventive approach. Our goal is to assist employers in establishing effective litigation avoidance techniques by advising on and creating comprehensive personnel policies and procedures. When disputes occur, our goal is to maximize results in the most efficient manner possible based on the facts and law applicable and the needs of our clients; when it comes to litigation, we are keenly aware that one size does not fit all.

Services for Employers

Employers turn to ECJ for counseling on employment policies and compliance issues, as well as to defend them against employment-related claims. We regularly produce informative publications to advise clients of the most up-to-date employment issues and preventative measures. (See our Publications page for issues of our Employment Law Reporter and our more cheeky blog, The Staff Report.)

The lawyers in our Employment Law Department routinely provide the following legal services:

- Defending employers in state and federal courts in all types of employment lawsuits, including wrongful termination, sexual harassment, employment discrimination, wage and hour violations and class actions;

- Representing employers before enforcement government agencies, including the Division of Labor Standards Enforcement, the Department of Labor, the California Department of Fair Employment and Housing, the Equal Employment Opportunity Commission, the Attorney General, the Employment Development Department, and the Occupational Safety and Health Administration;

- Counseling on wage and hour compliance, exempt status, hiring and firing issues, reductions in force, relocation problems and all other employee management issues;

- Counseling clients on how to effectively and efficiently resolve personnel problems, including assisting with internal complaints, as well as incident-free terminations;

- Providing complete and thorough investigation services, including conducting investigations on discrimination, harassment and retaliation allegations and working in conjunction with management personnel to make ultimate determinations and recommendations;

- Assisting employers in complying with the Americans with Disabilities Act, the Family Medical Leave Act, and various states’ family and medical leave acts;

- Drafting employee policy handbooks and additional employment-related policies, including enforceable arbitration policies;

- Drafting various employment-related agreements, including employment, consulting and independent contractor agreements, separation and release agreements, and all forms of employee equity and compensation;

- Drafting agreements, policies and strategic plans for the protection of confidential information, intellectual property and trade secrets; and

- Training management in employment-related obligations, including sexual harassment, discrimination, sensitivity training, managing medical leaves and successful terminations.

Professionals

Practice Group Chair

Media & Events

Client Alerts

Blog Posts

Publications

Events

Successes

Successes

Employee Handbook

Employee Handbook

ECJ's Employee Handbook program keeps you in compliance with CA employment law.

California’s latest wave of employment legislation introduces a broad set of new requirements taking effect in 2026. Federal and local authorities have also added to the evolving regulatory landscape for California employers. Beginning in 2026, key changes at the state, federal, and local levels will include, among others:

-

Expanded state paid sick leave entitlements;

-

Expanded leave and entitlements for victims of violence;

-

Expanded Paid Family Leave rights;

-

New employee rights posting requirements;

-

New immigration-related notices;

-

Expanded personnel recordkeeping requirements;

-

New pay scale and equal pay regulation requirements;

-

New immigration-related emergency contact requirements;

-

New whistleblower rights in certain industries;

-

New restrictions on the use of employment-related artificial intelligence tools;

-

Developments regarding recent ban on certain “forced” work meetings; and

-

Additional changes based on caselaw, administrative decisions and guidelines, and other developments that took place throughout the year.

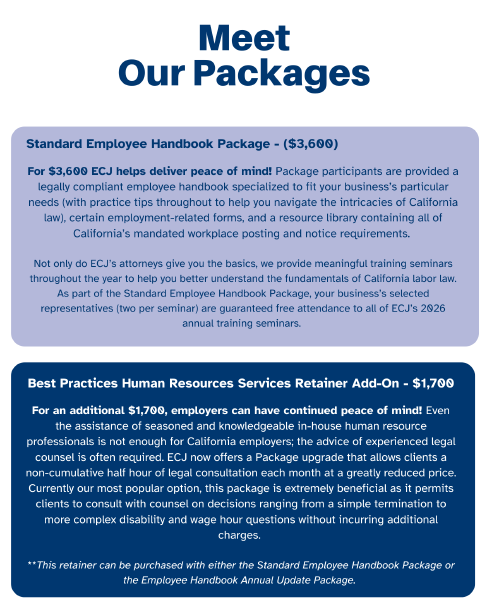

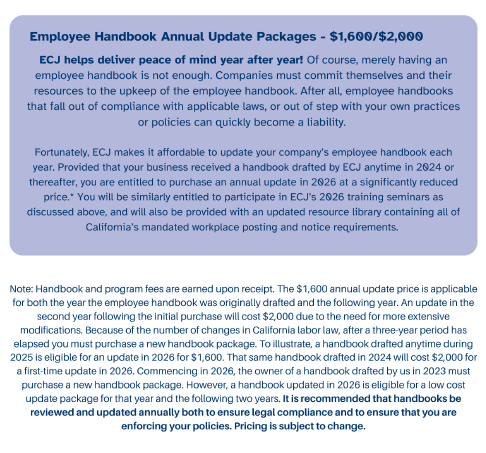

A soundly drafted and appropriately implemented employment handbook is an employer’s first line of defense against claims. Unfortunately, as too many employers have come to realize the hard way, “off the shelf,” pro forma employee handbooks and related forms are no substitute for thorough and customized policies carefully crafted by licensed attorneys specializing in California employment law. Luckily, reaching legal compliance does not need to break the bank.

At ECJ, we recognize that one size does not fit all. We understand the importance of an interactive drafting process between our clients and our attorneys. Whether to address changes in the law, developments in technology or employment policies that no longer complement your business needs, ECJ’s attorneys will speak with you directly to ensure that you maximize the benefit of our employee handbook program for your workplace. In addition, in the process of updating or creating your handbook, you will be given the opportunity to consider updating or creating other important employment documents based on recent developments, such as a confidentiality agreement, a binding arbitration agreement for employment disputes, newly required privacy employee/applicant notices and consents (including those related to biometric data and geolocation tracking), and the new requirements for a workplace violence prevention plan and indoor heat illness prevention plan, and related mitigation measures.

For questions and order form submissions email, marketing@ecjlaw.com.

Copyright © 2025 Ervin Cohen & Jessup, All rights reserved.

Employer Audit Compliance Service

Employer Audit Compliance Service

THE NEED FOR A LABOR LAW COMPLIANCE AUDIT IS REAL!

PROTECT YOUR BUSINESS WITH ECJ’S NEW EMPLOYER AUDIT COMPLIANCE SERVICE

Why do California employers need to conduct audits of their payroll, timekeeping and labor practices? Since 2004, the Private Attorneys General Act (“PAGA”) has terrorized employers by permitting individual employees to sue employers on behalf of themselves, other employees and the State of California to recover civil penalties for California Labor Code violations. Thankfully, employers were given some relief last year when Assembly Bill 2288 and Senate Bill 92 were signed into law. These bills amended PAGA to provide employers with an opportunity to minimize the potential penalties under the statute. But to take advantage of this opportunity, employers must act proactively and take “all reasonable steps” to be in compliance. Those “reasonable steps” are defined to include whether an employer conducted periodic payroll audits and acted in response to the results of the audit, disseminated lawful written policies, trained supervisors on wage order compliance, and took appropriate corrective action with regard to supervisors.

Preparation is Critical!

If all reasonable steps are taken, PAGA penalties will be capped at $15.00 per violation if the employer does so before receiving the notice of violation, or capped at $30.00 if the employer takes reasonable steps within 60 days after receiving notice of PAGA violations.[1] Not only that, but taking these reasonable steps should also serve to reduce the risk of expensive wage and hour claims—and the likelihood of success of such claims—in general.

What We Offer

Package 1: Basic PAGA Compliance Plan

Includes:

- A payroll audit based on a sampling of wage statements and timekeeping records taken from the last 12 months to assess compliance with overtime and meal and rest period premium requirements, and paid sick time calculations;

- A review of the employer’s written wage and hour policies and procedures; and

- A review of wage training materials used by the employer over the prior 12 months.

Package 2: Intermediate PAGA Compliance Plan

Includes:

- A payroll audit based on a sampling of wage statements and timekeeping records taken from the last 12 months to assess compliance with overtime and meal and rest period premium requirements, and paid sick time calculations;

- A review of the employer’s written policies and procedures;

- An update of the employer’s written policies and procedures (as needed);

- Preparation of wage training materials for employer implementation; and

- A review of corrective actions taken by the employer in connection with wage and hour compliance training.

Package 3: Advanced PAGA Compliance Plan

Includes:

- A payroll audit based on a sampling of wage statements and timekeeping records taken from the last 12 months to assess compliance with overtime and meal and rest period premium requirements, and paid sick time calculations;

- A review of the employer’s written wage and hour policies and procedures;

- An update of the employer’s written wage and hour policies and procedures (as needed);

- Preparation of wage and hour training materials and conducting a wage training seminar for supervisory employees on the employer’s behalf; and

- A review of corrective actions taken by the employer in connection with wage and hour compliance training.

Package 4: Comprehensive PAGA and HR Compliance Plan

Includes:

- A payroll audit based on a sampling of wage statements and timekeeping records taken from the prior 2 years to assess compliance with overtime and meal and rest period premium requirements, and paid sick time calculations;

- A review of the employer’s written wage and hour policies and procedures;

- An update of the employer’s written wage and hour policies and procedures (as needed);

- Preparation of wage and hour training materials and conducting a wage training seminar for supervisory employees on employer’s behalf; and

- Additional Human Resources auditing to include:

- An assessment of all human resources files and work authorization forms;

- A review and assessment of hiring and termination processes

- A review and assessment of all of employer’s employment policies and procedures, including timekeeping and recording employee time, exempt/non-exempt classifications, incentive bonusses or commission plans, and other critical areas;

- Review and assessment of mandatory job postings both in the workplace and to the public;

- Review and assessment of mandatory employment record retention;

- Review and assessment of required written illness and injury prevention and workplace violence prevention plans;

- Review and assessment of recommended or required management trainings, including sexual and unlawful harassment prevention training, workplace violence prevention training, and indoor/outdoor heat illness prevention training (as applicable).

Price estimates for each Package are available upon request and depend on the nature of the employer, the size of the employer, the number of physical locations for the employer, among other factors.

Employer Audit Compliance Service Order Form

[1] It is important to be mindful that the PAGA penalty cap does not apply and the penalties are subject to statutory increases if 1) there was a prior determination that the employer’s policy/practice was unlawful within the last 5 years, or 2) the employer’s conduct is determined by a court to have been malicious, fraudulent, or oppressive.

For questions and order form submissions email, marketing@ecjlaw.com.

Copyright © 2025 Ervin Cohen & Jessup, All rights reserved.